A simple guide to understanding what you should do if you have an accident

Are you an average driver?

According to research, it is estimated that the ‘average driver’ shall file a claim for a collision around once every 17.9 years [1].

So, if you started learning to drive at 17 and swiftly passed both your theory and practical driving tests, you are estimated to have an accident by 35 years old – although, this is an average. The likelihood of being involved in an accident as you begin to solo drive is far greater; up to 23% of drivers aged 18-24 are involved in a crash within six months of passing their driving test [2].

Hopefully, if this is correct, the accident will be minor – maybe just a small graze, or the slightest of bumps.

In 2018 alone, the UK experienced 122,635 accidents on its roads[3], but thankfully, the majority of these instances are for accidents considered to be ‘slight’.

But would you know what to do if you were part of these statistics? Or if it was more serious?

Who would you call? What should you do next?

What steps you should take if involved in an accident?

Here at insurethebox, we know it can be difficult to think of the right thing in a frightening situation – I mean, if it’s nearly 18 years between accidents, who’s going to remember the correct steps to take?

Well one or two of you might – but let’s assume the majority of us are mere mortals with forgetful brains

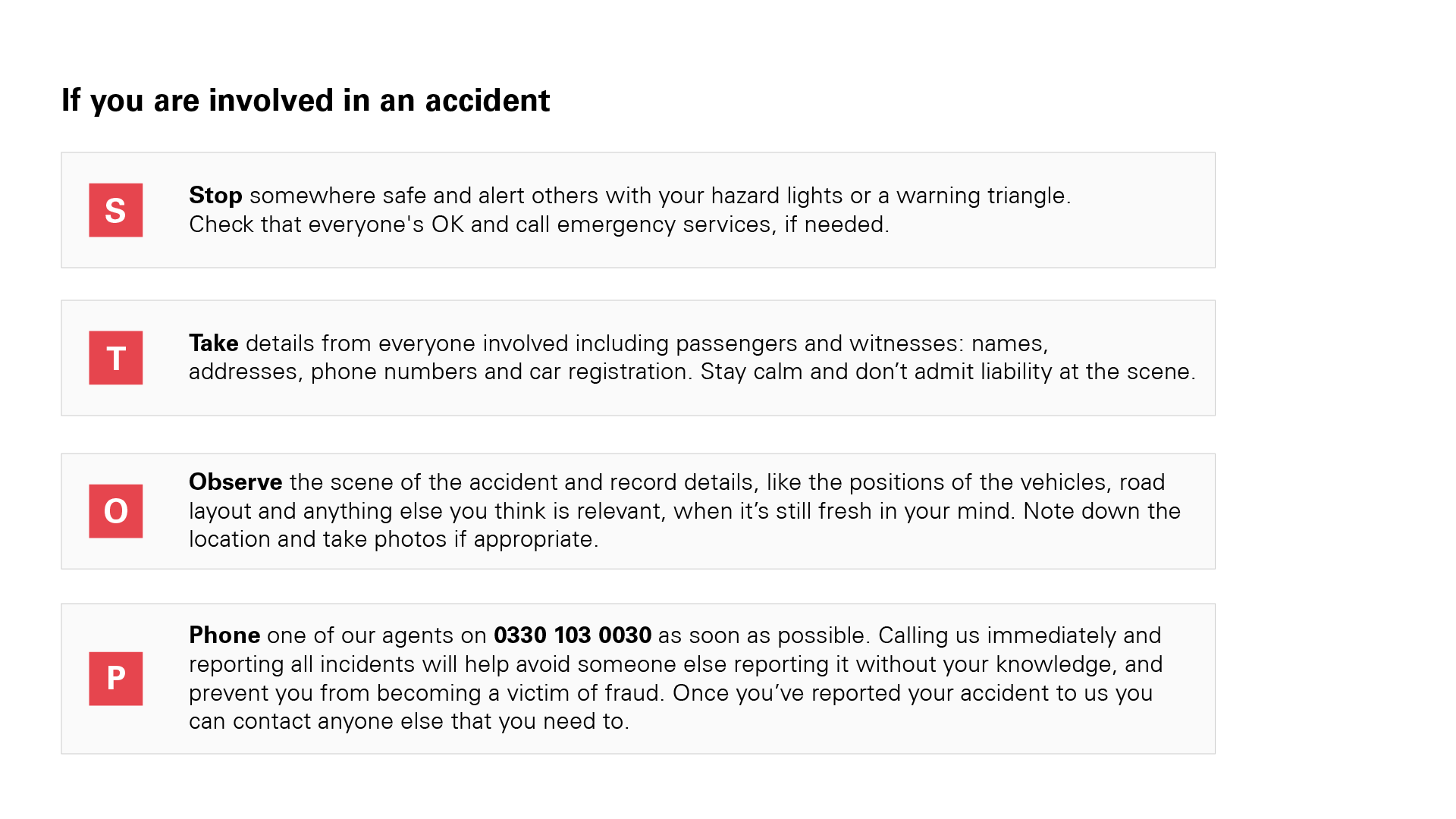

This is exactly why we have put together a simple way to help. Remember to S.T.O.P!

Stop

Whatever the scenario, there is a legal requirement for all vehicles to stop at the scene of an accident[4].

It’s incredibly important that you make sure you stop somewhere safe – not only for your safety, but for other drivers too. Check your surroundings and do some simple safety checks to avoid blocking traffic flow or obstructing the public highway.

If you can, either apply your hazard lights or set out a warning triangle to clearly demonstrate that you are stopped for oncoming vehicles.

Once these safety steps have been completed, you will need to talk to the owner of the other car; this may not be the most fun conversation in the world, but it’s absolutely necessary. Make sure they are safe and un-injured – if you need to, call 999.

Take

Take all the personal details from everyone involved in the accident.

Yes, this means your own passengers too, and any witnesses. This is a vital step, collecting details can help make the claims process much quicker.

It’s important to collect the following:

- Drivers, Passenger(s) & Witness(es) name(s).

- Home address(es).

- Phone numbers.

- Car registration.

Observe

Hang on before you leave the scene of the accident – there is more information you should ideally take to help ease the processing of your claim.

This goes beyond the personal details – it’s best to collect all this information when it’s still fresh in your mind:

- Take pictures of the road layout.

- Take note of the damage caused to both cars.

- Note down your location.

- If you can, collect witness statements.

- Anything else you think is relevant to the situation.

Phone

This is arguably the most important step – you pay insurance for a reason. It’s so, when situations like this happen, you are covered.

Call your insurer as soon as you possibly can after the accident. Yes, that does mean ringing before you tell your parents.

Doing this will avoid someone else reporting the incident without your knowledge and help you avoid being a victim of fraud – make the process of fixing your car or getting your finances sorted that much quicker.

insurethebox customers:

Save our Claims number 0333 103 0030 on your phone now so that you can reach us quickly when needed.

Our friendly team are here to help you 24/7 and guide you through what you should do next.

Once you do this, feel free to ring your parents and let them ease your stress.

Getting in an accident can be scary – no matter how serious it is. But we can help you to make the process that much simpler and let you focus on de-stressing after the incident. Remembering to S.T.O.P is incredibly important so that we can process your claim correctly and quickly!

[1] https://www.forbes.com/sites/moneybuilder/2011/07/27/how-many-times-will-you-crash-your-car/#b0d5274e6217

[2] https://www.theaa.com/resources/Documents/pdf/young-drivers-at-risk.pdf

[3] https://roadtraffic.dft.gov.uk/custom-downloads/road-accidents/reports/cb45b909-4519-4b00-b2b3-1b44c2924693